Investing is an excellent way to build wealth and plan for your financial goals. It’s also the primary method for saving for retirement, and it can help you reach many other financial milestones along the way. When you start early, you are able to enjoy financial independence and security.

Young people have a considerable advantage when it comes to investing. By starting in your 20s rather than waiting until later decades you have the potential to grow significantly more wealth, take advantage of technological innovations, and take on slightly more risk.

Keeping aside a portion of your salary when you start earning, possibly in your early or mid-twenties, is a sure-shot way to secure your financial future. It is all about spending less than your earnings and investing the difference. Investment habits, when inculcated early, can reward you with a stress-free financial life.

Benefits

I. More risk appetite

Investments such as equities or mutual funds are able to deliver higher returns. These are risky investments because of their exposure to market volatility. However, an individual in his early 20s generally will not have too many responsibilities and is able to assume higher risks to earn greater returns. As life progresses, marriage, children, and other responsibilities increase, which reduce the risk appetite of most individuals. Therefore, youngsters are recommended to open a demat account online and start investing today.

II. Debt-free purchase through goal-based investing

Most people tend to fund their big purchases by taking debt and incurring interest cost, thereby increasing the cost of purchases. For example, if you buy a car worth Rs 5 lakh on a car loan with 20% down payment. At 12% interest rate for a 4-year loan tenure, the cost of purchase will increase by Rs 1.06 lakh, paid in the form of interest. Instead, if you start investing Rs 8,000 each month from the age of 23 in a balanced fund SIP, offering 12% average rate of return, you can easily reach the Rs 5 lakh target by the time you turn 27. Thus, with little forward planning and financial discipline, you can easily make your big purchases without incurring debt and additional interest cost.

III. Higher retirement corpus

It is important to start planning for retirement early in life. This gives sufficient time to individuals to build a good retirement corpus, which ensures their financial freedom during their golden years. When a person begins early, he will need to invest a smaller amount to build the desired corpus. However, as he grows older, the investment amount increases, which may result in financial difficulties. Using the Systematic Investment Plans (SIPs) route to accumulate mutual funds in the demat account is recommended to build a good retirement corpus.

IV. Time Value of Money

Early investments lead to compounding returns. The time value of money increases over a period of time. Regular investments made right from an early age can reap huge benefits at the time of retirement. Moreover, early investment facilitates your entry into the world of finance early. Your money grows with time. Because of early investments, you can afford things which others might not, at that age. This puts you ahead of others who prefer investing at a later stage of life.

Let’s illustrate it with an example :

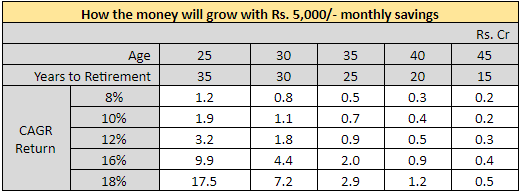

Jim and William started working at the age of 25 years and both want to retire at 60. As observed from the table, with a monthly investment of Rs. 5,000, from the age of 25, Jim will end up with a corpus of Rs 3.2 crore at CAGR return of 12 per cent p.a. when he retires. With the same amount of investment and return assumption, William who starts investment at the age of 35, will accumulate only Rs 0.9 crore. Now, to retire with the same amount of Rs 3.2 crore, William needs to invest approximately Rs 17,000. This itself demonstrates the importance of early investing as it encompasses the power of compounding.

Since you have got an idea what are all the benefits of early investing, now let's jump into how and through what you all will invest :-

Think of the various types of investments as tools that can help you achieve your financial goals. Each broad investment type, from bank products to stocks and bonds has its own features, risk factors and ways in which they can be used by investors.

- Stocks

- Bonds

- Annuities

- Mutual Funds

- Insurance

Stocks

When you invest in a stock, you become one of the owners of a corporation. Stocks represent ownership shares, also known as equity shares. Whether you make money or lose money on a stock, it all depends on :

- The success or failure of the company

- The type of stock you own

- What’s going on in the stock market

- And other factors

Bonds

Bonds are said to be a debt instrument in which the issuer company borrows money from the lender (bond holder) and, in return, is obliged to pay interest on the principle amount While there are many investment options in India, bonds are considered as a safe instrument because of the low risk involved in it.

Annuities

An annuity is a contract between you and an insurance company in which the company promises to make periodic payments to you, starting immediately or at some future time (at the time of an employee’s retirement). You buy an annuity either with a single payment or a series of payments called premiums.

Mutual funds

It is a pool of money managed by a professional Fund Manager. It is a trust that collects money from a number of investors who share a common investment objective and invests the same in equities, bonds, money market instruments and other securities. And the income/gains generated from this collective investment is distributed proportionately amongst the investors after deducting applicable expenses and levies the money pooled in by a large number of investors is what makes up a Mutual Fund

Know the difference between saving after spending and spending after saving

We can end the discussion with one more piece of advice from the Investment Guru, Warren Buffet – “Do not save what is left after spending; instead spend what is left after saving.” Great advice is hidden for all of us within this simple sentence. It is a common tendency for the youngsters to spend lavishly when they are in their early earning period; maybe they deserved it, after the years of education, hard-work and struggle they put in. However, if a little caution is applied here, they can be made aware of the difference between need, want and desire. This will help them to start investing early and by now, we all know, the benefit of the same. So, have you started investing? If not, better start now.