What is Income ?

‘Income’ does not only mean money earned in the form of salary. It also includes, profits from business or income from house property, gains from profession, income from other sources, etc.

The government often provides certain leeway such that various deductions are made from an individual’s income before the tax to be levied is calculated.

What is Tax ?

A charge or burden laid upon persons or the property for the support of a Government is known as ‘Tax’. It is a compulsory payment to be made by every person in India (condition apply).

The rates and the items on which tax will be charged, like income tax, GST, etc is decided by the Government. Taxes are the source of revenue for the Indian Government.

Now what’s Income Tax ?

Income tax is a type of tax that the Central Government charges on the income earned during a financial year by the individuals and businesses.

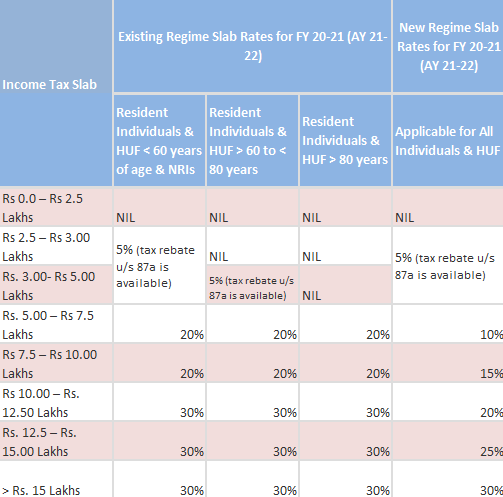

The Government changes the income slabs and tax rates every year in its Union Budget. Taxes are mainly of two types, Direct tax and Indirect tax. Income tax is a form of direct tax.

Income tax slab rates for FY 2020-21 (AY 2021-22) New Tax Regime & Old Tax Regime